Why I quit being a life insurance agent?

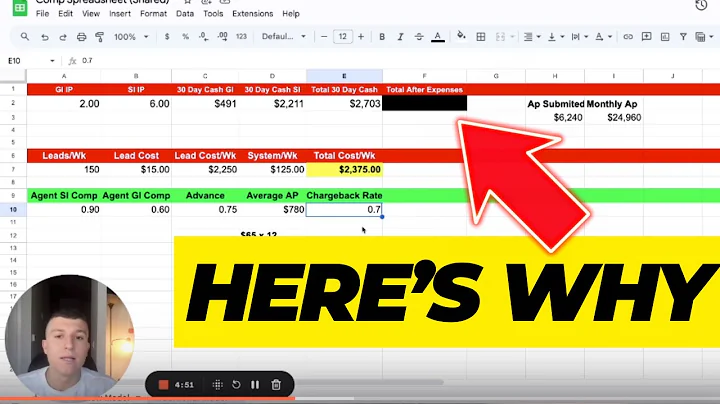

I ran out of money to invest in leads. 26.2% voted a lack of money for leads as their primary reason why they quit. Less important reasons agents quit selling insurance include running out of prospects, personal issues like health problems, and discovering the business wasn't a right fit.

Insurance agents succeed when they prioritize their customers' needs over their own profits. The most commonly cited reason insurance agents fail is that they fail to listen to their customers and take the time to find the best product to suit their needs.

The burnout rate for life insurance sales agents is high. More than 90% of new agents quit the business within the first year. The rate increases to greater than 95% when extended to five years.

An agent who is only out to earn a commission, regardless of the needs of the client, is not likely to last long in the business. Agents and brokers who listen carefully to what their clients and prospects say will be able to earn their trust, which is the hardest part of their job.

- Unpredictable income. Working in a commission-based role has its drawbacks. ...

- High-pressure work environment. Selling insurance can be stressful. ...

- Finding new leads can be challenging. ...

- Limited paid time off. ...

- Experiencing a lot of rejection.

Highlights: Key Facts About Insurance Agents in 2024

On average, 57.9% of first-time insurance exam takers pass the test. Insurance agents make on average $51,936 per year. The average age of an Employed insurance agent is 45.9 years old.

Building trust with potential clients is perhaps the most demanding part of selling insurance.

No Trust in the Insurance Agent or Insurance Company

Some are just paranoid, but others have had past experiences that justify their lack of trust. Whether it has been lack of service from their agent or not being treated fairly on a claim, bad experiences can put a very negative light on the insurance industry.

One of the primary reasons insurance agents can accumulate wealth is their commission-based income structure. Unlike salaried employees, agents earn a percentage of the premiums they sell to clients. As they build a client base and generate more sales, their income potential increases.

- Family First Life. 3.5 $114,181per year. 417 reviews54 salaries reported.

- New York Life. 3.7 $80,828per year. 3,913 reviews257 salaries reported.

- Farmers Insurance Group. 3.5 $67,888per year. ...

- Aflac. 3.5 $64,459per year. ...

- GEICO. 3.2 $62,402per year. ...

- Show more companies.

Is life insurance declining?

In addition, life insurance ownership among adults in the United States declined from 63 percent in 2011 to 52 percent in 2023.

Historically, turnover rates in the insurance industry have increased from 8-9% to 12-15% recently, indicating that retaining employees is becoming more difficult (Deloitte United States).

That is a 90% failure rate for new agents.

Most independent marketing organizations will train insurance agents on all the products they want them to sell. Then the independent marketing organization will train the insurance agent to ask a few questions and learn a sales presentation that just sells a product.

As an insurance agent, you may think that being an introvert is a disadvantage when it comes to selling insurance. However, being introverted can be an advantage in this industry, as introverts often excel at building deep relationships and listening to the needs of clients.

A sales career in health insurance (or virtually any industry) can be challenging. Clients are not always easy to deal with; some may view your role negatively. Rejection is a routine part of the job. The burnout rate for first-year insurance agents is high; according to some sources, it tops 90%.

Life insurance is a very difficult product to sell. Simply getting your prospect to acknowledge and discuss the fact they are going to die is a hard first step. When and if you clear that hurdle, your next task is creating urgency so they buy right away.

High earning potential

Another factor that makes life insurance a good career path is the opportunity to earn a high salary with strong growth potential. Life insurance agents and brokers, in particular, generate commission-based incomes that are among the highest in the entire insurance industry.

Life insurance is the most profitable—and the hardest—type of insurance to sell. With the highest premiums and the longest-running contract, it brings in cash over a long period of time. In the first year, agents make the largest annual sum on a policy, bringing in anywhere from 40–120% of the policy premium.

In fact, many agents new to insurance are fearful, knowing they face a high risk of failure. How many agents quit selling insurance? There isn't an exact number. But we figure somewhere between 90% and 95% of agents quit in their first 12 months of receiving their license.

A life insurance agent's income potential is uncapped. Some of the highest earners make well over six figures each year, while others choose to work as part-time insurance agents to earn some extra cash.

What is the best age to start life insurance?

If you can fit the monthly premium into your budget, your 20s are the best time to buy affordable term life insurance coverage. If you have a spouse and dependent children who rely on you for financial support, your coverage needs will likely be more significant than a single, childless person.

Some agents, advisors, and multi-line agents made a million dollars in the first year they worked with us selling life insurance! While most of the others it took 2, 3, or more years to make a million dollars per year selling life insurance. (We are not recruiters.

Becoming an insurance agent can be a great side hustle for those looking to earn extra income while helping others and growing personally. With a bit of training and networking, you can start building your client base and earning commissions in no time.

State Farm had the highest rating for overall customer satisfaction in J.D. Power's 2022 U.S. Individual Life Insurance Study, with a score of 843 (the study's average was 790). It also has a three-year average NAIC complaint index of 0.46, which means the company had fewer complaints than expected for its size.

Applicants, policyholders, and third-party claimants can commit insurance fraud during a transaction to obtain benefits to which they're not entitled. Insurance scams can occur in any sector but are typically most prevalent in healthcare, workers' compensation, and auto insurance.